Your Books Don’t Need to be Perfect- They Need to be Accurate!

One of the biggest misconceptions business owners have about bookkeeping is that their books need to be perfect.

Perfectly categorized.

Perfectly documented.

Perfectly updated every single day.

That belief alone causes many business owners to delay bookkeeping altogether — which is far more damaging than imperfect records.

The truth is simple: Your books don’t need to be perfect. They need to be accurate.

And there’s a big difference.

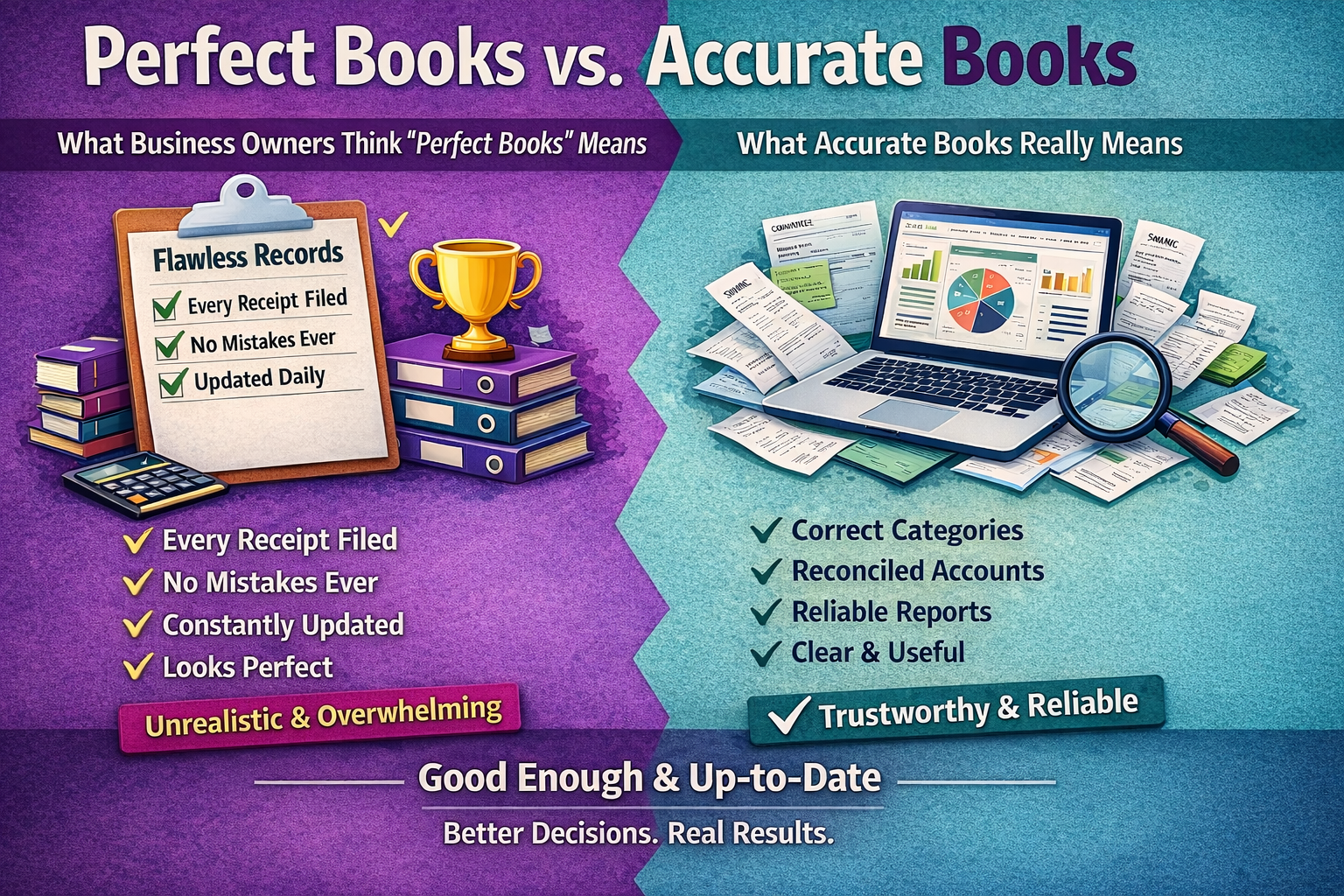

What Business Owners Think “Perfect Books” Means

When I talk with business owners, “perfect bookkeeping” usually means:

• Every receipt is saved and labeled

• Every transaction is categorized flawlessly

• Nothing is ever misposted

• Books are updated constantly with zero errors

That level of perfection feels overwhelming — especially when you’re busy running the business, managing clients, employees, and growth.

So instead of moving forward, many business owners freeze… and the books get pushed off month after month.

What Accurate Books Actually Mean

Accurate bookkeeping isn’t about perfection, it’s about reliability.

Accurate books mean:

• Transactions are categorized correctly

• Bank and credit card accounts are reconciled

• Financial reports reflect what’s truly happening in your business

• Numbers can be trusted to make decisions

Accuracy ensures that what you see on your profit & loss statement and balance sheet matches reality —not guesses, assumptions, or outdated data.

Why Accuracy Matters More Than Perfection

Accurate books allow you to:

• Understand your cash flow

• Make informed business decisions

• Plan for taxes with confidence

• Identify problems early

• Measure real profitability

Perfect-looking books that aren’t accurate are actually dangerous. They create false confidence, and that’s how business owners end up overspending, underpricing, or getting blindsided at tax time.

Clarity always beats perfection.

What Happens When Books Aren’t Accurate

When bookkeeping isn’t accurate, business owners often experience:

• Unexpected tax bills

• Cash flow shortages

• Inability to answer basic financial questions

• Stress during CPA meetings

• Poor decision-making based on incorrect data

Inaccurate books don’t just affect numbers — they affect growth, stability, and peace of mind.

You Don’t Need to “Fix Everything” Before Getting Help

Another common myth is:

“I need to clean things up before I hire a bookkeeper.”

That’s simply not true.

A professional bookkeeper’s job is to bring clarity, organization, and accuracy — even when things are messy, behind, or overwhelming.

Waiting for perfection only delays progress.

Final Thoughts…

Your bookkeeping doesn’t need to be flawless.

It needs to be accurate, timely, and useful.

When your numbers tell the truth, you gain confidence in your decisions — and your business is able to move forward with clarity instead of guesswork.

Need Help Getting Your Books Accurate?

If you’re unsure whether your books are truly accurate or you’ve been putting things off because they don’t feel “perfect,” BookWorx by Finney can help bring clarity and organization to your financials.

Click the button below to schedule a consultation and take the guesswork out of your numbers.